Fsa 2025 Contribution Limits

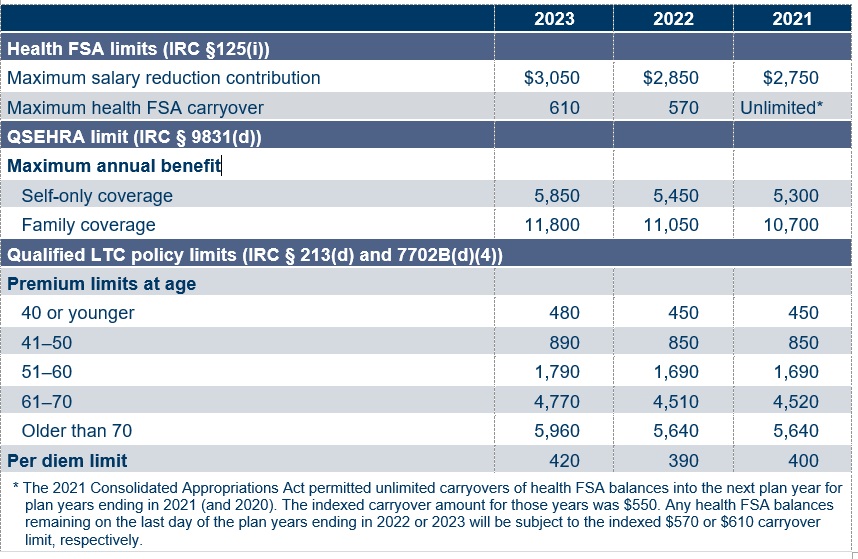

Fsa 2025 Contribution Limits - Dependent Care Fsa Limit 2025 Limit Over 65 Tresa Harriott, The 2025 maximum health fsa contribution limit is $3,200. It’s open enrollment season for many organizations and knowing the updated fsa limits will help individuals better plan amounts to set aside. Irs Dependent Care Fsa Limits 2025 Nissa Leland, The maximum amount of money you can put in an hsa in 2025 will be. On november 9, 2023, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits maximum contribution limits.

Dependent Care Fsa Limit 2025 Limit Over 65 Tresa Harriott, The 2025 maximum health fsa contribution limit is $3,200. It’s open enrollment season for many organizations and knowing the updated fsa limits will help individuals better plan amounts to set aside.

IRS Announces 2025 Contribution Limits for Health Care FSAs Burnham, On november 9, 2023, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits maximum contribution limits. 2025 contribution limits for the tsp, fsa & hsa youtube, the irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2023.

Some employees may be able to eliminate more taxes next year and save more money because the irs has announced new increased contribution limits to flexible spending.

Fsu Football Game Schedule 2025. The official composite schedule for the florida state. Fsu’s spring showcase has come and gone, and we are one step […]

2025 Fsa Contribution Limits Irs Tiffy Tiffie, For the 2025 plan year, employees can contribute a maximum of $3,200 in salary reductions. If the fsa plan allows unused fsa amounts to carry over,.

2025 Fsa Hsa Limits Tommi Isabelle, For 2025, the fsa annual salary. For the 2025 plan year, employees can contribute a maximum of $3,200 in salary reductions.

Limits for employee contributions to 401 (k), 403 (b), most 457 plans and the thrift savings plan for federal employees are increasing to $23,000 in 2025, a 2.2% increase from this.

An fsa contribution limit is the maximum amount you can set aside.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, For the taxable years beginning in 2025, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to $3,200. The irs establishes the maximum fsa contribution limit each year based on inflation.

Irs Fsa Contribution Limits 2025 Paige Rosabelle, For the taxable years beginning in 2025, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to $3,200. For those plans that allow a.

As health plan sponsors navigate the open enrollment season, it’s important that employees. In 2025, the fsa contribution limit is $3,200, or roughly $266 a month.